Does today's uncertainty really bring (real estate) opportunity?

It’s been a bizarre few weeks for the Vancouver real estate market, which we’ll unpack in this mid-month edition of the newsletter.

With prices down year-over-year, and interest rates cut by 225 basis points since April of last year - surely, we’d see sales skyrocket heading into the spring market, no?

Negative.

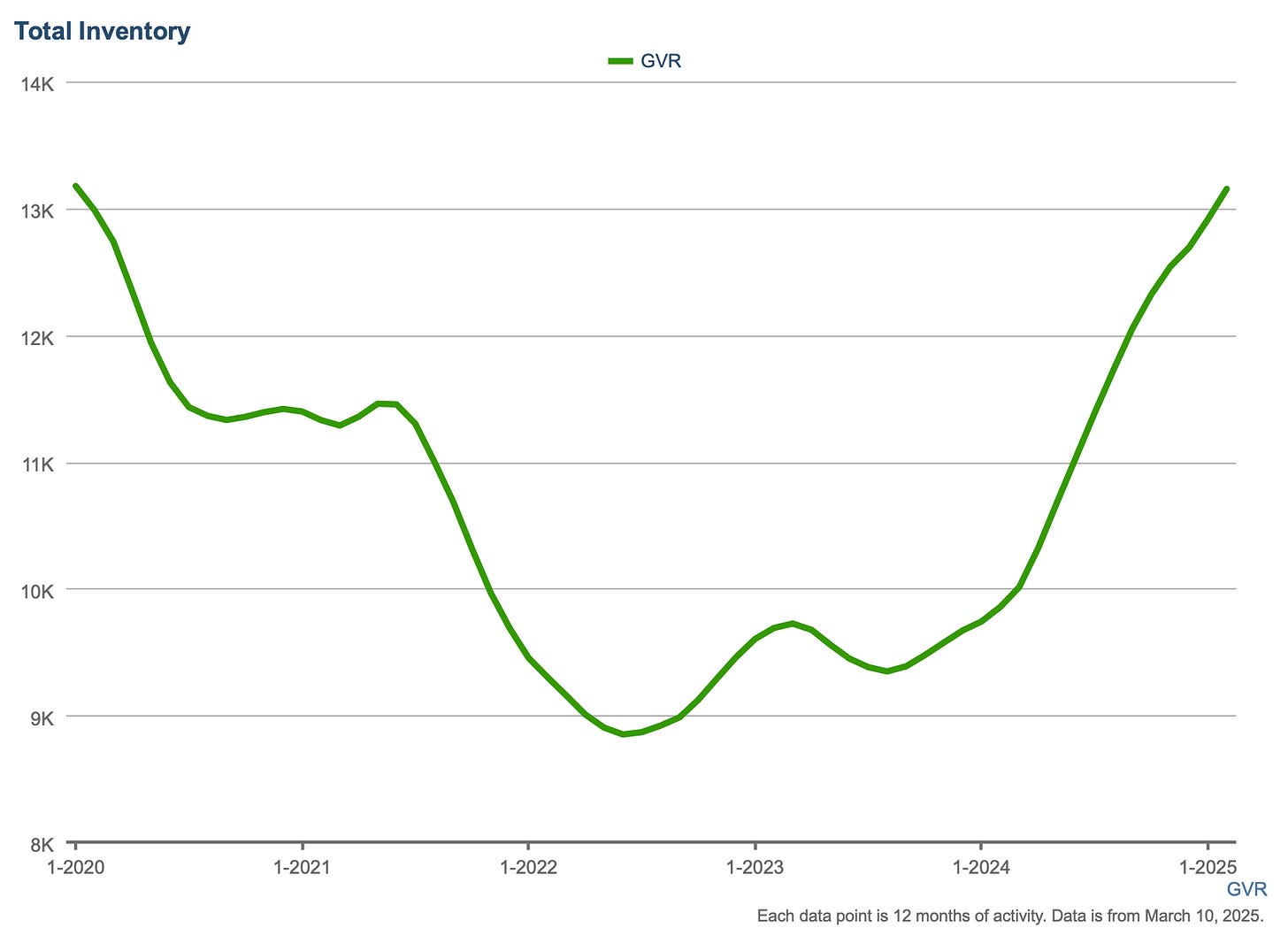

Negative headlines (which we’ll talk about in a sec), and housing inventory that continues to grow to new heights - both putting a damper on a typically robust Spring season:

It’s really quite remarkable actually. It wasn’t that long ago in 2023 when industry professionals (myself included) were staring down a “housing supply crisis”. Well, things change quick.

Or as they say - ask, and ye shall receive.

The degree of “livable” inventory available on the market is arguable - much of the listing growth has been in the condo space, and there’s only a certain segment of the population willing to live in 450 square feet as a property owner, vs. 700 square feet and continue to rent.

But, I digress.

The second ingredient in this cocktail of depressants is an upcoming trade war that no one has any clarity on, except this guy:

The only certainty is that it’s happening, and that the media is having a field day with it already.

Just glance at recent headlines, and you’ll understand quickly why the collective reservation exists:

"Unwarranted And Reckless": Canada's Housing Industry Reacts To Tariffs

How U.S. tariffs could shake up B.C. real estate

and of course, this:

Trump tariffs like 'sword of Damocles' hanging over Vancouver real estate

Meanwhile, Wednesday saw the Bank of Canada cut rates for the 7th consecutive time. The only certainty they were able to provide is that we are likely to be living in uncertain times for the foreseeable future.

Which begs the question - for those that can stomach it, can this market actually offer up some opportunity?

The divergence between presale condo prices and resale condo prices continues to grow, as developers struggle to get projects off the ground:

There are even some rumblings that incoming Liberal leader Mark Carney is having discussions with the development community about allowing foreign investment into presales again.

Yup, the future is that bleak when it comes to new construction.

Make no mistake about it, Canada is putting fewer shovels into the ground on new projects, and we will feel the effects of this in 3-5 years time.

Meanwhile - investors holding newly-built resale condos, are finally coming to grips with selling at losses or renting at rates that have been dropping for over a year.

Once this condo inventory is eaten up, and it may take a long while, we don’t have a ton on the horizon. And if we’re thinking reducing immigration is going to quell any demand, we might need to think again.

Canada continues to entice population growth from other countries, recently by fast-tracking thousands of construction workers into the country and towards PR, while BC attempts to lure doctors & nurses from then U.S. as the trade (and human capital) wars heat up:

Now this need for new housing colliding with a need to bring in skilled workers is not a potential train wreck that is lost on the BC Government, and specifically Premier David Eby.

Eby was at a BC Real Estate Association event in Victoria last week, where he was said to encourage new housing investment, and even offered up a potential opportunity for “mom and pop” landlords to invest in professionally-managed, purpose-built rentals.

The trend is the same however…a shift towards new rental housing construction and a city that will be dominated by leasehold condos and minimal freehold ownership opportunities.

So for the strong stomachs out there, and the ones that are able to cancel out the headline noise, we might be on to something.

And this large set of resale condos, might in fact be the opportunistic play for certain long-term buyers in today’s market.